Mumbai, May 31, 2022: Surya Roshni Limited, the largest exporter of ERW Pipes, largest producer of ERW GI pipes and one of the largest Lighting Companies in India, has declared its audited financial results for the quarter and financial year ended March 31, 2022.

Consolidated Financial Performance Highlights

Q4FY22 Highlights

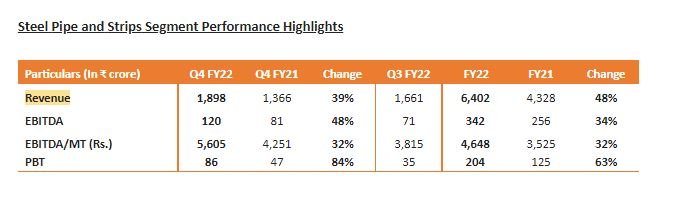

Ø Healthy 39% growth in revenue driven by all the divisions of B2C, B2B, Exports and higher Steel

prices, mainly the price of HR coils

Ø 13% volume growth in Q4FY22 due to growth across business divisions and higher growth in value- added products and markets including API & Spiral Pipes, Actual Users and Exports

Ø EBITDA/MT in Q4FY22 increased to ₹ 5,605 as compared to ₹ 4,251 in Q4FY21

Ø No major impact on supply chain due to the ongoing global geopolitical conflicts

Ø Witnessing robust order flow with enquiries remaining consistent in value-added products

Ø The company has received the highest-ever single order of 3LPE API coated pipes valuing ₹608.6

crore (incl. GST). The total order book now exceeds ₹ 1,000 crore

FY22 Yearly Highlights

Ø Revenue of ₹ 6,402 crore in FY22 as compared to ₹4,328 crore in FY21, an increase of 48%

Ø EBITDA/MT for FY22 improved to ₹ 4,648 as compared to ₹ 3,525 YoY, due to improved product mix of value-added products. API & Spiral Pipes and Exports registered a volume growth of 62% and 25%, respectively

Ø Better working capital management improved working capital utilization, despite a sharp increase in steel prices during the year. For full year basis, the working capital days has reduced from 71 days to 55 days

Commissioned large-dia section pipe facility with DFT Technology:

Ø Commissioned the Large-dia section pipe facility with Direct Forming Technology (DFT) at Gwalior in mid-April, 2022, which has also added a capacity of 36,000 MTPA of the new product categories.

Ø Will enable the company to further improve its presence in domestic as well as export markets

Q4FY22 Highlights

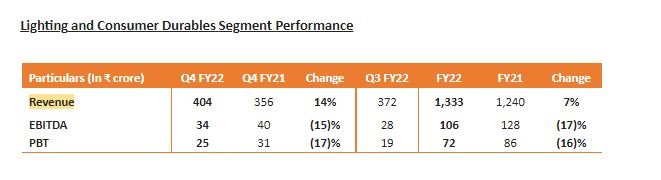

Ø Q4FY22 witnessed growth across all business divisions of B2C and B2B, both on a sequential and last year basis

Ø 23% growth in LED Lighting revenue on a YoY basis. Share of value-added products like LED battens and Down-lighters improved along with volume growth

Ø EBITDA margins witnessed improvement on a sequential basis, however subdued from the last year on account of increase in material cost upto 10% due to continuous inflationary pressure in raw material prices and input costs

Ø Company pro-actively undertook multiple price hikes to partially mitigate the increased input costs

FY22 Yearly Highlights

Ø LED lighting witnessed strong revenue growth of 18% during FY22, with growth in both B2C and B2B

Ø Consumer Lighting grew by 16%, with higher growth of value-added products

Ø Professional Lighting witnessed 10% growth in revenue, with consistent flow of orders

Ø LED lighting bulbs replacement cost has witnessed a major reduction

Ø Conventional lighting witnessed de-growth of 11%. Consumer durables has recovered well with the ongoing summer season, earlier impacted by higher commodity prices

Ø The year has seen an unprecedented increase in input costs, particularly in Oil, Natural Gas and

Commodity prices. With partial price increases, EBIDTA margins remained impacted during the year

Ø Surya approached the year with aggressive advertisement and marketing campaigns through TV advertisements, print and digital media

Ø Working Capital days have improved during FY22 to 73 days from 77 days in FY21, with a focused approach on the collection, higher use of channel financing and managing global supply chain challenges

Commenting on the results, Company’s Managing Director, Mr. Raju Bista, said “We are delighted to report the highest ever revenue for the company, achieved revenue milestone of $ 1 billion. I would like to attribute this phenomenal achievement to our team’s relentless efforts and emphasis on innovation, product and market development, premiumization and strong brand equity.

For FY22, the top-line grew by 39%, underpinned by a healthy product mix driven by growing share of value-added products across Steel Pipes, Lighting and Consumer Durables. This resilient performance reflects operational excellence, with a better mix and healthy profitability despite multiple headwinds.

The company has now repaid all the long-term debt and has become a long term-debt free company. The company has only short-term working capital debt, which the company is planning to optimize further in the coming quarters. The company’s Steel Pipes & Strips and Lighting & Consumer Durables businesses are now independent and self-sustaining in terms of profitability, debt servicing and investment for growth, resulting into constant growth in revenue and profitability, coupled with upgrades in credit ratings.

In the Steel Pipes and Strips, the company reported a revenue growth of 39% in Q4 and 48% in FY22 and a healthy growth in profit before tax (PBT) of 84% in Q4 and 63% in FY22. The improvement in realizations were driven by higher steel prices and consistent increased share of margin accretive API pipes and Exports. The company’s focus on premium products and geographical diversification of plants has worked well, translating into improvement in profit margins. The recently inaugurated large-dia DFT manufacturing facility is expected to enhance the margin profile further. Going forward, the company will continue to focus on growing the revenue share of value-added products and exports.

In Lighting and Consumer Durables, the company has witnessed revenue growth in LED Lighting with 23% in Q4 and 18% in FY22. The new age product lines are gaining strong momentum with special focus on LED battens and LED down-lighters which registered volume growth of 50% and 100% respectively. We continue to launch premium products as per market needs. The company is witnessing a healthy momentum in the Fans segment on account of a severe heatwave across the country. During the year, the company undertook multiple price hikes to partly mitigate the impact of higher commodity prices and other input costs. We remain focused to enhance profit margins by improving product mix through growing share of premium products and smart lighting.

Initiatives such as Salesforce Automation (SFA) have been rolled out across all the regions and have started contributing to productivity enhancement, focused approach to bring down replacement cost has worked well. The company has intensified advertising and branding activities in order to transform into modern, innovative and stylish brand.

The company is witnessing good enquiry order inflow and will continue to focus on participating in multiple Smart Lighting projects in Professional Lighting. The company also strengthened further the semi-urban and urban distribution network, which is now one of the largest in the industry.

The company is witnessing multiple triggers such as a growing mix of value-added products across segments, strengthened balance sheet, strong value propositions and cost rationalization. This, coupled with improved economic activity is expected to drive the growth in the upcoming quarters.

The company has given responsibility of Chief Financial Officer (CFO) to Mr. Bharat Bhushan Singal, who is also playing a role of Sr. V.P. and Company Secretary since last 26 years. He is a well-qualified professional, a Chartered Accountant, Company Secretary & Cost Accountant and has played a key role in various strategic initiatives over the years and is well-versed with company’s system and processes. I congratulate Mr. Singal for his new role and look forward to work closely with him to achieve the goals, going forward.”