Many businesses add crypto payments after facing slow cross-border transfers and rigid traditional processors. The real difficulty, however, appears after the first transactions: choosing a crypto merchant service that stays reliable under everyday conditions. Most companies compare basic factors like supported currencies or fees, but these only cover the surface. The actual challenges emerge later, when small issues in settlement, customer behavior, accounting, or automation start affecting operations and revealing how much the choice of provider truly matters.

The Standard Checklist: Important but Not Sufficient

Businesses typically begin with a familiar set of requirements. They want predictable fees, support for major assets like Bitcoin and USDT, a clean checkout page, and APIs that connect with their website or app. They check whether settlement happens instantly, whether the platform supports their preferred networks, and how quickly funds can be withdrawn.

These are reasonable expectations, and any merchant service should meet them. But the reality of crypto transactions is more nuanced than a static feature list. Accepting crypto means working with customers who use different wallets, networks, and habits. It also means dealing with assets that behave differently from traditional money. The real test of a merchant solution lies in how it handles these differences.

Where Real-World Challenges Actually Appear

Once payment processing becomes part of daily operations, a new set of concerns emerges—issues that rarely appear in marketing pages but matter deeply to merchants.

1. Customer payment behavior is unpredictable

A customer might begin paying with Bitcoin, then switch to USDT midway because of a fee spike. Another might use a wallet that automatically subtracts network fees, causing the received amount to be slightly less than the invoice. Some customers hold most of their balance on a different chain than the one they select at checkout.

Systems that only support one-asset payments or require exact amounts often generate unnecessary failures. Flexible flows—such as mixed payments or automatic underpayment handling—eliminate the need for follow-ups and prevent lost sales.

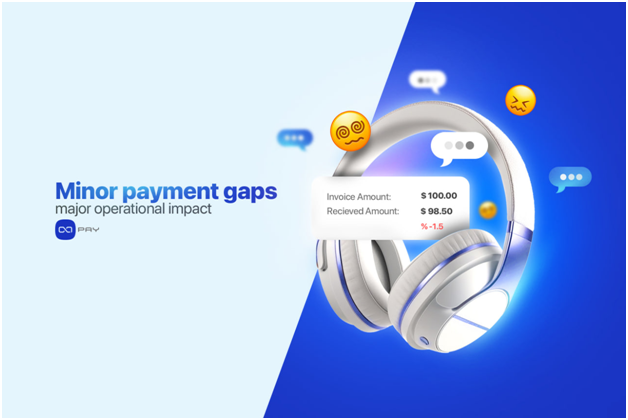

2. Small payment inaccuracies create major operational load

Even a two-percent underpayment can trigger a chain of manual tasks: contacting customers, adjusting orders, reconciling balances, issuing partial refunds. These issues consume significant time when they happen repeatedly. Merchant services that automatically detect and resolve these discrepancies keep operations manageable as volume grows.

3. Accounting clarity matters more than most merchants expect

Crypto adds an extra layer to bookkeeping. Finance teams need to know the exact fiat value at payment time, the asset used, the settlement value, and the associated order. When records are incomplete or spread across multiple dashboards, reconciliation becomes slow and error-prone. Systems designed with proper documentation—PDF invoices, fiat-equivalent tracking, exportable reports—remove guesswork from accounting.

4. Automation is not a luxury, it is a requirement

A business accepting tens or hundreds of payments a week cannot rely on manual checks. Automated callbacks, real-time status updates, and scheduled withdrawals reduce operational weight. They turn crypto from an experimental feature into a dependable payment channel that does not require constant supervision.

5. Error prevention saves more time than error resolution

Most failed crypto payments occur not because of fraud or technical issues, but because customers make simple mistakes: choosing the wrong network, copying an address incorrectly, or sending funds from a wallet that rounds values differently. A strong merchant service minimizes these mistakes by guiding the user with validated addresses, QR-codes, network filtering, and clear instructions. Merchant teams avoid unnecessary support tickets, and customers face fewer frustrations.

6. Integration paths influence long-term success

Businesses evolve. A company that begins with simple payment links may later require backend automation or e-commerce plugins. Merchant services that support multiple integration styles allow companies to expand without switching platforms. The lack of these options becomes a bottleneck as payment volumes rise.

These are the aspects that reveal themselves only after real usage begins. They are not always obvious during product comparison, yet they determine whether a merchant service feels reliable in practice.

Selecting a Merchant Solution With These Realities in Mind

Businesses evaluating crypto payment providers benefit from looking beyond surface-level specifications. The most effective approach is to consider how the system behaves under real conditions, not ideal ones.

A reliable merchant service should:

- Maintain fiat-based pricing to stabilize settlement

- Support flexible payment completion to reduce failed transactions

- Provide clear financial records aligned with accounting needs

- Automate repetitive operational tasks

- Prevent common user errors before they occur

- Offer different integration paths for different stages of growth

These criteria reflect the practical issues businesses encounter, not theoretical concerns. When a platform is designed around these realities, the adoption curve becomes smoother and crypto can function as a stable part of the payment stack.

Choosing the Right Crypto Payment Solution for Your Business

Selecting a crypto payment gateway requires a clear understanding of your business’s needs. OxaPay provides a comprehensive solution for merchants, covering essential features like easy integration, multi-currency support, competitive fees, and fast settlement. However, it also addresses operational challenges that many payment systems overlook.

Solving Real-World Crypto Payment Challenges

OxaPay goes beyond the basics by focusing on often-overlooked operational details. For example, its automated settlement process instantly converts payments to stablecoins, minimizing currency fluctuations. This ensures smooth and predictable settlements, particularly for cross-border transactions.

The Details That Truly Matter in Crypto Payments

OxaPay also automatically handles underpayments, reducing manual follow-ups. Additionally, features like accurate financial reporting, fiat tracking, and robust security help businesses avoid errors. Crypto invoices for businesses are seamlessly managed, with clear fiat equivalents and easy integration with existing accounting systems.

These operational details, often overlooked initially, become crucial once payments are live. OxaPay ensures crypto payments are easy to manage, secure, and reliable, while minimizing operational complexity.

Conclusion

Choosing a reliable merchant payment gateway isn’t just about supported assets or transaction speed. The real challenge lies in how the system handles day-to-day operations, including small payment discrepancies, customer behavior, accounting complexities, and the need for automation. A merchant payment gateway that addresses these operational realities ensures a smooth, reliable, and scalable experience, making crypto payments a stable part of a business’s global payment strategy.