The cement industry delivered a steady and broad-based performance in 2025, supported by strong infrastructure spending, sustained housing demand, and capacity expansion across key markets. While growth rates varied by region, the sector largely outperformed expectations, emerging as one of the more resilient segments within the global construction and materials space this year.

Demand recovery anchored in infrastructure and housing

Cement demand in 2025 was primarily driven by government-led infrastructure programmes, including highways, rail corridors, ports, airports and urban development projects. Housing activity—both affordable and mid-income—also provided consistent volume support, particularly in emerging economies.

India stood out as a major growth engine, while Southeast Asia, the Middle East and parts of Africa also reported stable consumption. In contrast, demand in parts of Europe and North America remained moderate, reflecting slower construction cycles and tighter financial conditions.

Capacity expansion and consolidation reshape the sector

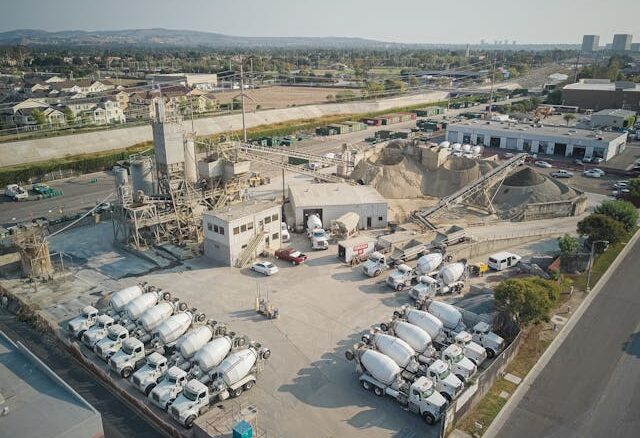

A defining trend of 2025 was aggressive capacity addition combined with consolidation. Large cement producers continued to scale up operations to capture long-term demand visibility and improve cost efficiencies.

In India, consolidation under groups such as UltraTech Cement and Ambuja Cements helped stabilise pricing and strengthen regional dominance. New grinding units, clinker expansions and logistics investments were rolled out across multiple states, signalling confidence in sustained demand growth.

Globally, producers focused on optimising plant utilisation and logistics rather than reckless capacity creation, helping avoid severe oversupply risks in most markets.

Pricing discipline supports margins

After facing margin pressure from fuel and power costs in previous years, cement companies saw improving profitability in 2025. Softening energy prices, higher use of alternative fuels, and better freight management supported operating margins.

Importantly, pricing discipline improved across several regions. While price hikes were incremental, they were largely sustained, reflecting a more mature and consolidated market structure. Analysts noted that even modest price increases had an outsized impact on earnings due to operating leverage.

Sustainability moves from compliance to strategy

Environmental considerations gained sharper focus in 2025, with cement producers accelerating efforts to reduce carbon intensity. Increased adoption of blended cements, alternative fuels, waste heat recovery systems, and renewable power sourcing became more mainstream.

Low-carbon cement variants began gaining acceptance in public infrastructure projects, signalling a gradual shift from pilot initiatives to commercial deployment. While decarbonisation remains capital-intensive, companies increasingly view sustainability as a competitive advantage rather than a regulatory burden.

Regional performance snapshot

-

Asia (led by India): Strong volume growth, improving margins, and high capacity utilisation

-

Middle East & Africa: Stable demand driven by infrastructure and energy-linked projects

-

Europe: Moderate recovery, selective infrastructure-led demand

-

North America: Mixed performance amid slower housing starts and high interest rates

Market sentiment and outlook

Equity markets largely rewarded cement stocks in 2025, particularly those with scale, cost efficiency, and strong balance sheets. Investor sentiment remained positive on the sector’s medium-term outlook, viewing cement as a direct beneficiary of public capital expenditure cycles.

Looking ahead to 2026, the key variables to watch include:

-

Pace of infrastructure spending

-

Cement price sustainability

-

Energy and logistics costs

-

Execution of capacity additions

Bottom line:

The cement industry’s 2025 performance highlighted its strategic importance to economic growth. With demand visibility improving, margins stabilising, and sustainability becoming integral to operations, the sector enters the next year on a structurally stronger footing—well-positioned to capitalise on long-term infrastructure and urbanisation trends.