A few years ago, empty car lots and halted assembly lines made the semiconductor shortage impossible to ignore. The worst of that crisis — which shook the industry between 2020 and 2022 — has passed. Showrooms are fuller, production is steadier, and supply chains are functioning better than before.

But beneath the surface, a quieter and more complex challenge remains.

In 2025–2026, the automotive industry is no longer facing a dramatic, across-the-board chip collapse. Instead, it is navigating a structural imbalance — a targeted shortage of specific semiconductors, fierce competition from AI companies, and long-term shifts in how vehicles are designed and produced.

The crisis has changed shape. And it may have permanently changed the industry.

A Different Kind of Shortage

Today’s chip shortage does not look like the one the world remembers.

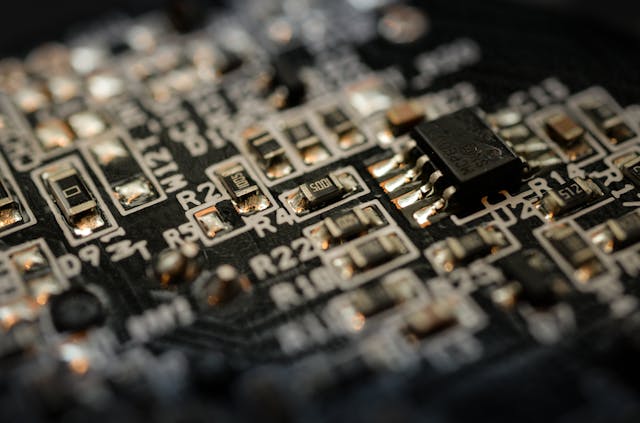

Automakers are not scrambling for the most advanced processors used in smartphones or AI servers. Instead, the real pressure lies in so-called mature-node semiconductors — chips built on older manufacturing processes (typically 40nm and above).

These chips may sound outdated, but they are essential in cars. They control:

-

Engine and powertrain systems

-

Braking and steering modules

-

Battery management in EVs

-

Climate control

-

Airbags and safety electronics

In other words, they are the invisible workhorses of modern vehicles.

For years, semiconductor manufacturers invested heavily in advanced nodes to serve booming markets like artificial intelligence, cloud computing, and high-performance electronics. Older production lines received less attention because they generate lower margins.

Now, that underinvestment is catching up with the automotive sector.

The AI Effect: A New Competitor for Chips

Artificial intelligence has added a powerful new dimension to the supply chain equation.

Data centers running large AI models require enormous volumes of advanced chips. These customers place large, high-value orders and often secure long-term manufacturing agreements.

From a business perspective, semiconductor foundries naturally prioritize these clients.

Automotive manufacturers, despite producing millions of vehicles, often order chips in smaller batches with lower margins compared to AI companies. This creates an imbalance — and sometimes places the auto sector lower on the priority list.

The competition is not hostile, but it is intense. And it is reshaping production planning worldwide.

The Hidden Bottleneck: Packaging and Assembly

Even when semiconductor wafers are produced, they must go through advanced packaging — a process that integrates and assembles chips into usable components.

This back-end stage has quietly become one of the industry’s tightest constraints.

As vehicles become more software-driven and feature-rich, they require more complex chip integration. Packaging capacity is limited and often booked years in advance.

This means that even if raw chip production increases, the final output can still be delayed.

It’s a reminder that modern supply chains are not just about raw materials — they are about every step in the process.

From Efficiency to Resilience

Before the pandemic, “just-in-time” manufacturing was the gold standard. Automakers kept inventories lean, reduced warehousing costs, and relied on precise timing.

That model worked — until it didn’t.

The semiconductor crisis exposed how vulnerable tightly optimized systems can be when a single link breaks.

Now, many manufacturers are shifting toward a “just-in-case” strategy. They are:

-

Building larger inventory buffers

-

Securing long-term supply contracts

-

Working directly with chip manufacturers

-

Diversifying sourcing across regions

Efficiency is still important, but resilience has become equally critical.

Carmakers as Technology Companies

One of the most remarkable shifts in 2025–2026 is how automakers are redefining themselves.

Cars today are computers on wheels. Electric drivetrains, digital dashboards, over-the-air updates, and advanced driver assistance systems all rely on semiconductors.

To reduce dependency, some manufacturers are designing their own chips tailored to their vehicle architectures. This move allows them to optimize performance, secure dedicated production capacity, and integrate software more seamlessly with hardware.

The line between car company and tech company is blurring.

Geopolitics and Regional Diversification

Global trade tensions and export controls have also reshaped supply strategies.

Certain semiconductor materials — such as gallium and germanium — have faced export restrictions in recent years. These measures highlight how geopolitical events can quickly disrupt supply chains.

In response, automakers and chip manufacturers are diversifying production geographically. Investments in semiconductor facilities are expanding in North America and Europe, while alternative manufacturing hubs are growing in India, Mexico, and Eastern Europe.

However, semiconductor fabrication plants take years to build and even longer to operate at full capacity. While progress is being made, immediate relief remains limited.

How Vehicles Are Changing

Chip constraints are influencing not just production schedules, but also product design.

Some automakers have simplified lower-end models by reducing non-essential electronic features. Others are consolidating multiple control units into centralized computing systems.

At the same time, the industry is accelerating its transition to software-defined vehicles (SDVs). Instead of relying on dozens of specialized chips scattered throughout a car, manufacturers are moving toward modular architectures with centralized processors that can handle multiple functions.

This approach reduces chip variety, simplifies design, and allows software updates to add features over time.

The goal is not only innovation — it is adaptability.

The Consumer Impact

Semiconductor shortages and supply adjustments have increased production costs. Combined with inflationary pressures, this has pushed vehicle prices higher in many markets.

Consumers may notice that:

-

Entry-level models have fewer features

-

Delivery times for certain trims are longer

-

Prices are higher than pre-pandemic levels

While supply has improved compared to peak crisis years, affordability remains a concern in some regions.

What Happens Next?

Industry experts suggest that supply-demand imbalances may persist into late 2026. New fabrication plants and policy-driven investments — including government-backed semiconductor initiatives — are beginning to add capacity, but results will take time.

Normalization is gradual, not immediate.

The industry is unlikely to return to the pre-2020 model of hyper-lean, globally concentrated supply chains. Instead, a more diversified and risk-aware structure is emerging.

A Permanent Lesson in Silicon

The semiconductor shortage of 2025–2026 is not a dramatic shutdown event. It is something subtler — a reminder that modern vehicles are deeply intertwined with the global technology ecosystem.

Every electric vehicle, every advanced driver-assistance feature, and every digital dashboard depends on reliable access to chips.

The auto industry has learned that managing steel, rubber, and labor is no longer enough. Managing silicon is just as important.

This is not just a supply chain story. It is a transformation story.

Cars are becoming more intelligent, more connected, and more software-driven. And as they do, semiconductor strategy will remain central to automotive success.

In today’s world, the future of mobility is written not only in metal and motion — but in microchips.