Summary: As crypto derivatives continue to dominate trading volume in 2025, competitive fees and leverage options have become key factors distinguishing the best futures exchanges.

Today’s traders prioritize cost efficiency, liquidity, and risk control, making zero-fee or low-fee futures environments highly attractive.

This guide reviews the five cheapest futures trading platforms that deliver exceptional affordability, top-tier execution, and a full suite of professional tools.

These exchanges combine minimal costs with innovation, liquidity, and global reach:

- MEXC – Zero-Maker-Fee Futures & Up to 500× Leverage

- Bybit – Tight Spreads and Tiered Fee Discounts

- Binance Futures – High Liquidity with Fee Rebates

- Bitget – Low-Fee Copy Trading & Perpetual Contracts

- OKX – Flexible Margin Futures with DeFi Integration

How We Chose These Platforms

Our ranking focuses on exchanges offering the lowest real trading costs and strongest execution reliability.

The evaluation covered five essential dimensions:

- Maker/Taker Fees: Comparative analysis of USDT-M and Coin-M perpetuals.

- Leverage Range: Maximum available leverage and stability at high exposure.

- Hidden Costs: Funding rates, liquidation fees, and withdrawal structures.

- Liquidity & Spread Control: Depth and consistency across markets.

- Incentives & Rebates: Campaigns, VIP tiers, and zero-fee promotions.

Each featured exchange provides verified, transparent fee structures and proven liquidity metrics from CoinMarketCap and official documentation.

Comparison Table: Cheapest Futures Platforms in 2025

| Exchange | Maker Fee | Taker Fee | Max Leverage | Key Advantages |

| MEXC | 0.00 % | 0.01–0.05 % | Up to 500× | Zero-maker fees, tight spreads, insurance fund |

| Bybit | 0.01 % | 0.06 % | Up to 125× | Deep liquidity, professional tools, VIP tiers |

| Binance Futures | 0.02 % | 0.04 % | Up to 125× | High volume rebates, auto-deduction, mobile suite |

| Bitget | 0.02 % | 0.06 % | Up to 125× | Copy trading, flexible margin, airdrop bonuses |

| OKX | 0.02 % | 0.05 % | Up to 125× | Multi-currency margin, DeFi yield integration |

Data sourced from official exchange documentation and CoinMarketCap Derivatives pages (2025).

MEXC – Zero-Maker-Fee Futures & Up to 500× Leverage

Founded in 2018, MEXC has firmly positioned itself as the global leader in cost-efficient crypto derivatives trading. The platform distinguishes itself through 0.00 % maker fees and ultra-low taker fees starting from 0.01 %, enabling high-frequency and institutional traders to optimize every trade. MEXC supports USDT-M and Coin-M perpetual futures with leverage reaching 500×, one of the highest in the industry. Its high-performance engine executes thousands of orders per second, ensuring seamless performance during market volatility.

Beyond price, MEXC’s strength lies in its advanced risk architecture. It offers cross- and isolated-margin modes, dynamic liquidation protection, and a dedicated insurance fund. Regular zero-fee events, Kickstarter token campaigns, and rebate programs keep user costs minimal while maximizing engagement. For professional and retail traders alike, MEXC remains the most affordable, secure, and versatile futures platform available in 2025.

- Fees: Maker 0.00 %, Taker 0.00–0.05 %

- Leverage: Up to 500×

- Key Features: Zero-fee promos, insurance fund, fast execution, cross/isolated margin

- Notes: Best overall for cost + breadth; monitor funding rates on volatile pairs.

MECX Offers zero taker fee and zero maker fee.

Bybit – Tight Spreads and Tiered Fee Discounts

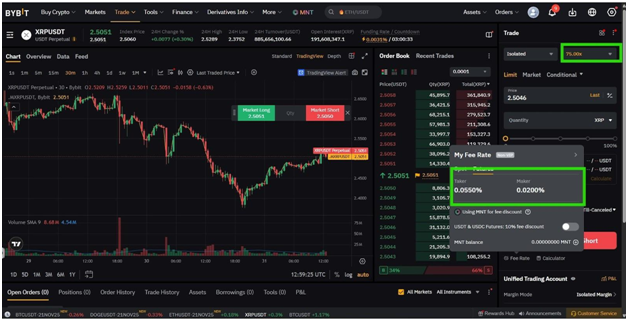

Launched in 2018, Bybit continues to impress with its combination of tight spreads, professional-grade infrastructure, and transparent fee tiers. The exchange’s standard maker fee of 0.01 % and taker fee of 0.06 % are further reduced through its VIP system, rewarding high-volume traders. With support for USDT-M, USDC-M, and inverse contracts and leverage up to 125×, Bybit has become a preferred venue for institutional traders seeking cost control and performance.

Its robust matching engine, capable of 100,000 transactions per second, ensures consistent execution speed. Meanwhile, Bybit’s Copy Trading, Bot automation, and Earn products appeal to retail investors seeking passive exposure with minimal fees. Educational content, 24/7 support, and real-time analytics make Bybit not only low-cost but also deeply user-centric, bridging pro-grade trading and retail accessibility.

- Fees: Maker 0.01- 0.02 %, Taker 0.06 %

- Leverage: Up to 75×

- Key Features: VIP tier discounts, copy trading, advanced order types, fast engine

- Notes: Great blend of speed, tools, and affordability for pros.

ByBit Offers Shown Fees and the maximum leverage indicated.

Binance Futures – High Liquidity with Fee Rebates

As the world’s largest derivatives exchange by trading volume, Binance Futures dominates in both liquidity and product diversity. It supports hundreds of perpetual pairs, up to 125× leverage, and institutional-grade stability. Maker/taker fees of 0.02 % / 0.04 % can drop via BNB holdings, VIP tiers, and volume rebates, allowing frequent traders to cut total cost per transaction below global averages.

Binance’s reliability is reinforced by multi-billion-dollar insurance funds, cross-collateralization, and auto-deleveraging mechanisms to reduce systemic risk. Advanced order types, intuitive dashboards, and a high-performance mobile app enhance usability. For those managing high capital flows, Binance provides the perfect mix of cost reduction, liquidity depth, and execution reliability unmatched by most competitors.

- Fees: Maker 0.02 %, Taker 0.04 % (lower with VIP/BNB)

- Leverage: Up to 125×

- Key Features: Liquidity at scale, rebates, strong mobile suite, risk controls

- Notes: Ideal for volume traders seeking consistent fills and discounts.

Binance offers some of the lowest taker fee and maker fee.

Bitget – Low-Fee Copy Trading & Perpetual Contracts

Founded in 2018, Bitget offers an appealing combination of simplicity, global accessibility, and low trading costs. Maker and taker fees are 0.02 % / 0.06 %, with leverage up to 125× across USDT-M, USDC-M, and inverse perpetuals. Its biggest differentiator is its copy-trading ecosystem, which lets users automatically mirror expert traders’ positions while maintaining transparent performance data.

Bitget enhances user experience through Launchpool campaigns, fee airdrops, and loyalty bonuses that effectively reduce total cost of ownership. The exchange’s global compliance, 24/7 support, and beginner-friendly interface make it especially attractive to newcomers. Bitget’s balanced blend of education, rewards, and affordability cements its reputation as one of 2025’s top cost-effective futures platforms.

- Fees: Maker 0.02 %, Taker 0.06 %

- Leverage: Up to 25×

- Key Features: Copy trading, Launchpool, global promos/airdrops

- Notes: Strong value for beginners and cost-conscious futures users.

With BitGet, you could get up to 25X leverage.

OKX – Flexible Margin Futures with DeFi Integration

OKX stands out in 2025 as a hybrid exchange bridging centralized trading with DeFi yield solutions. Its competitive pricing—0.02 % maker and 0.05 % taker—is paired with multi-currency margin, cross-collateral flexibility, and a unique Web3 wallet ecosystem. Traders can move seamlessly between perpetual futures and DeFi opportunities without transferring assets off-platform, creating a frictionless trading-to-yield pipeline.

The exchange offers perpetual swaps, options, and structured products, backed by Proof-of-Reserves verification and a transparent risk system. Its Web3 wallet supports staking, lending, and farming directly from futures profits. For those seeking both low-cost trading and on-chain functionality, OKX combines the best of both worlds—making it a prime destination for traders evolving toward decentralized finance.

- Fees: Maker 0.02 %, Taker 0.05 %

- Leverage: Up to 125×

- Key Features: Multi-currency margin, Web3 wallet, DeFi/yield tools, PoR transparency

- Notes: Great for traders who blend low-fee futures with on-chain strategies.

OKX has lower fees as well.

Tips for Cost-Efficient Futures Trading

- Use Maker Orders: Place limit orders to avoid taker fees on most exchanges.

- Leverage Fee Rebates: Participate in VIP or zero-fee programs to save on volume.

- Hold Native Tokens: BNB, KCS, and OKB reduce trading costs via loyalty discounts.

- Monitor Funding Rates: Even cheap fees can be offset by frequent funding costs.

- Check Campaigns: Zero-fee weeks and seasonal promos can cut expenses drastically.

Final Thoughts

In 2025, success in futures trading is no longer defined solely by leverage or volume—it’s about cost optimization and efficiency. Among all exchanges, MEXC clearly leads with its zero-maker-fee structure, 500× leverage, and aggressive liquidity strategy, setting the industry benchmark for affordability. Bybit and Binance Futures follow as professional-grade, deeply liquid environments, while Bitget and OKX appeal to traders prioritizing community access and DeFi integration.

For traders focused on profitability in volatile markets, these five platforms offer the lowest effective costs, strongest tools, and safest infrastructure available in 2025.