By Michael Brown Senior Research Strategist at Pepperstone

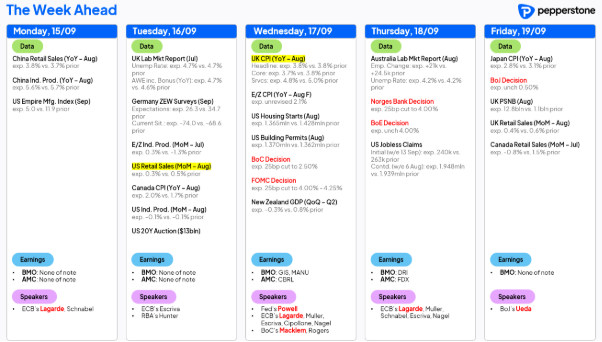

DIGEST – Markets didn’t do especially much on Friday, in a day that felt like the ‘calm before the storm’, with a monster docket ahead this week, including 5 G10 policy decisions, and a data deluge on both sides of the pond.

WHERE WE STAND – Trade on Friday was cagey, tentative, and frankly rather dull.

I shan’t complain too much, though, given how choppy most of last week proved to be, and taking into account the deluge of event risk that we’ve got coming up over the next few days. In fact, I’d argue that next week’s monstrously busy calendar is the main reason why the week ended on such a lacklustre note, as nobody sane would want to be carrying too much risk into what lies ahead.

As for catalysts on Friday itself, there weren’t many to digest. Data pointed to the UK economy having stagnated in July, on an MoM basis, though this was not only in line with expectations, but also stems from an incredibly noisy data series, that provides little of value overall. The same, to my mind, can be said about the UMich sentiment data – yes, the headline index unexpectedly fell to 55.4 from a prior 58.2, largely driven by a rise in long-run inflation expectations, but I struggle to believe that a survey of 400-odd people can tell us much about what an economy of >300mln people is doing.

Friday’s most notable news flow, though, came not only well after the close, but also well after I was tucked up in the land of nod; Friday nights are wild when you’re a market strategist, I tell you! That news, of course, was Fitch downgrading France’s sovereign rating by a notch to A+, and assigning a stable outlook. The issue here isn’t anything new, with France’s budgetary woes well known at this point, but is potentially more systemic in nature.

With France having now lost its ‘high grade’ moniker, further pressure on long-end OATs seems all-but inevitable. Were another of the ratings agencies to also announce a downgrade, that would well lead to forced selling among those only permitted to hold the highest grade govvies, not only piling further pressure on OATs, but also potentially posing a headwind to the EUR as well, if outflows were to markedly increase.

That’s all a longer-run story, though. In terms of market moves as the week drew to a close, there isn’t especially much to mention.

Equities closed practically unchanged, despite a bid making itself known in the tech sector once more, and despite President Trump calling this the ‘best stock market ever’. On that, I agree with him (makes a change!), even if it would be hard not to with both the SPX and NDX sitting at record highs. Though the week ahead for risk could be a bumpy ride, especially if the Fed deliver a message that lands hawkish relative to market expectations of 70bp easing by year-end, I still see the path of least resistance as leading higher, with economic and earnings growth solid, calmer tones prevailing on trade, and a looser monetary stance helping to juice things along further.

On that first point, we can allay some degree of nervousness over the state of the labour market, after it was confirmed late-Friday that last week’s surge in initial jobless claims, to the highest level since late-2021, was driven almost entirely by a host of fraudulent claims in Texas. Panic over, on that front, for now!

That goes some way to explaining the softness seen across the Treasury curve as the week wrapped up, though it quite clearly doesn’t change the overall narrative too much, which is one of the labour market, by and large, stalling. In any case, it was notable that the benchmark 30-year yield failed to close north of 4.70%, which had marked the bottom of the range traded since May until we broke below it earlier in the week. As noted the other day, I still see little reason to be bullish long-end Treasuries, or govvies anywhere in DM for that matter, amid runaway government spending, central banks seemingly having given up on the 2% inflation aim and, in the case of Treasuries in particular, the continued erosion of Fed independence.

That latter point continues to pose a longer-run structural headwind to the greenback, though neither the dollar, nor anything else in G10 FX, was particularly active as the week drew to a close.

One thing that does catch the eye, however, given how packed the week ahead docket looks, is how low vols are trading – a cable straddle expiring Friday implies a move of +/- a big figure, while EUR/USD and USD/JPY straddles over the same period price similarly modest moves. I wonder, perhaps, if Mr Market is a little too complacent as we move into what lies ahead this week.

LOOK AHEAD – As alluded to, it’s a bit of a monster of a week coming up.

Five central bank decisions are due across G10. The Fed will deliver a 25bp cut on Wednesday, though there will likely be both dovish dissents preferring a larger 50bp move, and hawkish dissents preferring to hold rates steady. Given those divisions, Powell is likely to emphasise optionality and the post-meeting press conference, while the updated dot plot should again point to a total of 50bp easing this year. A move lower in the median dot, to show 75bp of total easing this year, would require 8 members shifting their estimate lower, which seems a very tall order indeed.

Elsewhere, the BoC and Norges Bank are also set to deliver 25bp cuts of their own, while the BoE and BoJ should stand pat. The BoE, though, will likely trim the pace of balance sheet run-off, and shift active Gilt sales towards the front-end of the curve, while participants will seek to gauge how renewed political uncertainty may alter the BoJ policy path.

On the data front, US retail sales highlights proceedings, with the data set to show whether ongoing labour market weakness may be causing consumers to tighten their belts. On that note, the weekly jobless claims figures will also be watched closely, especially with the initial claims print coinciding with the September nonfarm payrolls survey week.

It’s a busy week of data on this side of the pond too, with the latest UK jobs, inflation, govt borrowing, and retail sales stats all due. The BoE will have advance sight of the first two prints ahead of Thursday’s policy announcement, with the CPI figures being by far and away the most important of all those releases, particularly with the ‘Old Lady’ expecting headline inflation to peak at 4%, double the MPC’s target, in September.

Meanwhile, a plethora of central bank speakers are due throughout the week, though most of these come from the ECB, and will likely repeat the message that the easing cycle is, for all intents and purposes, done and dusted. Participants will also, as always, keep a beady eye on trade and geopolitical developments over the coming sessions, as well as Trump’s ongoing efforts to fire Fed Governor Cook, which thus far courts in the US have continued to block.