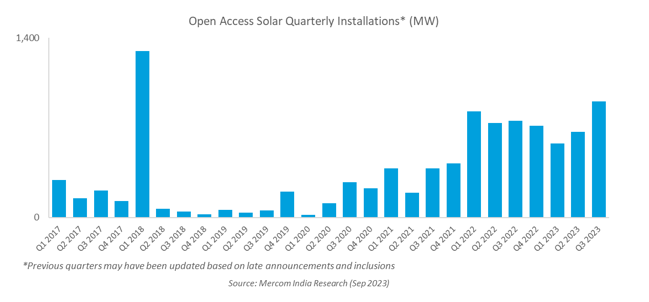

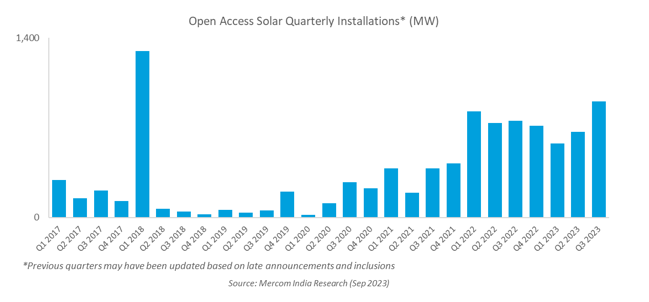

December 08, 2023 – In the third quarter (Q3) of the calendar year (CY) 2023, India added 907 megawatts (MW) of solar open access. The installations rose 36.1% quarter-over-quarter (QoQ) compared to 666 MW installed in Q2 2023, according to the newly released Q3 2023 Mercom India Solar Open Access Market Report.

Installations were up 20.6% year-over-year (YoY) compared to 752 MW installed in Q3 2022.

In Q3, developers increasingly commissioned projects to benefit from the lower power purchase agreement (PPA) tariffs due to the extension of the Approved List of Models and Manufacturers (ALMM) order until March 2024, and falling value chain prices have been driving capacity additions.

“The drop in solar project costs attracted consumer attention this quarter. Power purchase agreements that were on the back burner are now being signed. Emphasis on greening products and services has gained momentum in large and medium-scale enterprises and is pushing the growth of green energy open access market,” commented Priya Sanjay, Managing Director at Mercom India.

Maharashtra led the open access solar capacity additions in Q3 2023, with 26.5%, followed by Karnataka (20.3%) and Tamil Nadu (19.5%). The top five states accounted for 88.5% of the quarter’s installations.

In the first nine months (9M) of CY 2023, India added 2.2 GW of open-access solar, down 7.3% compared to 2.3 GW installed in 9M 2022. Installations were lower in the first half of 2023 as project development slowed in anticipation of further module price drops.

As of September 2023, the country’s cumulative installed open-access solar capacity was 11 GW.

Karnataka remained the top state, accounting for 33.3% of the cumulative solar open access capacity at the end of 9M 2023. Maharashtra and Tamil Nadu followed with 14.1% and 10.3% of the cumulative installed open-access solar capacity, respectively.

The top five states contributed 72.8% of the cumulative open-access solar installations.

India had 12.5 GW of open-access solar projects under various stages of development at the end of Q3 2023.

“Carbon-intensive industries exporting to Europe need to report the emissions that occur in the manufacturing process, failing which they lose business. Several multinational companies and premium brands worldwide have mandated their suppliers to go green. These initiatives will additionally drive demand for renewables,” added Sanjay.

Karnataka was the leading seller in the Green Day Ahead Market (G-DAM) in short-term markets, accounting for 16.3%.

Maharashtra was the leading energy procurer from G-DAM, followed by Damodar Valley Corporation, accounting for 28.4% and 13.8% of total power purchased.

Renewable Energy Certificates (REC) trading in the Indian Energy Exchange (IEX) was up 59% compared to the previous quarter.

According to the report, the volume traded in the Green Term Ahead Market (G-TAM) on IEX increased 55% QoQ.

A detailed analysis of the solar open access business overview, retail electricity tariffs, and open access charges and costs for seventeen states has been covered in the report.

Key Highlights from Mercom India Research’s Q3 2023 India Solar Open Access Market Report< /SPAN>

India added 907 MW of open-access solar capacity in Q3 2023, up 36.1% QoQ and 20.6% YoY

Maharashtra added the highest open-access solar capacity in Q3 2023

The top five states accounted for 88.5% of open-access solar installations in the quarter

Open access solar installations in 9M 2023 totaled 2.2 GW, down nearly 7.3% YoY

As of September 2023, the cumulative installed open-access solar capacity was 11 GW

12.5 GW of open-access solar projects were in the development pipeline at the end of 9M 2023