Amid the ongoing boom in artificial intelligence systems, major technology corporations are trying to reduce their dependence on Nvidia, which continues to dominate the AI accelerator market. Like competitors Google and Amazon, Microsoft has spent years developing proprietary chips for data centers, but its efforts have been hindered by delays and technological limitations.

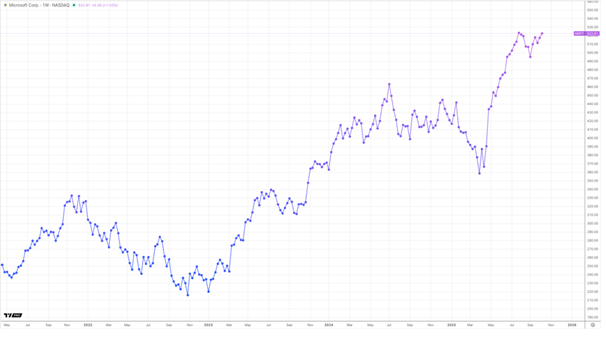

Microsoft’s stocks move closely in step with ES Futures. Any news about the company’s developments in AI or infrastructure chips directly affects investors’ expectations, which are embedded in the entire market. Difficulties in launching their solutions are perceived not only as a corporate risk but also as a factor that can affect the growth trajectory of the Big Tech sector, setting the tone for global indices.

Microsoft Technical Director Kevin Scott recently emphasized that the company is ready to build its infrastructure around its in-house technologies in the long term, from chips to cooling systems. The corporation is already using its own Maia accelerators and Cobalt processors in its data centers, but the share of these solutions still remains limited. According to Scott, the capacity shortfall is so severe that even the most ambitious Microsoft projects are insufficient.

Reality, however, is forcing adjustments: Microsoft’s first AI chip, codenamed Braga, is at least six months behind schedule and will not be able to compete with Nvidia’s Blackwell architecture in terms of performance. Design issues, staff turnover, and additional requests from OpenAI have further complicated the project. Moreover, developers have left some divisions, which casts doubt on Microsoft’s plans to roll out a full chip lineup by 2027.

The situation ultimately benefits Nvidia, which remains the leading supplier of accelerators for cloud giants – and, as the stock heatmap shows, continues to hold the largest market capitalization. The company effectively sets industry standards, with its solutions accounting for roughly 70% of the market for new AI data centers. Competitors’ attempts to create an alternative have not yet threatened its position, and Microsoft’s delays only reinforce the impression that real competition may still be years away.

While Microsoft is reportedly struggling with internal difficulties, the markets tell a different story. Investor optimism – fueled by the news about OpenAI’s $500 billion valuation and its agreements with Samsung and SK hynix – sparked a $200 billion surge in leading chipmakers’ market capitalization in a single trading session. In other words, investors fear missing out: despite the risk of a correction, the tech sector remains one of the main drivers of growth.

Microsoft’s situation highlights how even the largest corporations struggle to catch up with Nvidia in the technology race. Rather, the market responds less to competitors’ delays than to the sheer growth of the AI economy. Nvidia appears poised to maintain its dominance in the years to come, while Microsoft will need to strike a balance between its ambitions for strategic independence and the harsh realities of chip manufacturing.