Written by: Rania Gule, Senior Market Analyst at XS.com

Today’s global economic landscape is marked by complexities reflecting significant divergences in monetary policies among major economies, raising questions about the future of key currencies, particularly the U.S. dollar and the Japanese yen. The USD/JPY pair is trading near a five-month high of 158.38. The U.S. dollar has received a positive boost from strong economic data, including a rise in the U.S. services CPI to its highest level since 2023 and an unexpected increase in job openings. However, markets remained cautious as Federal Reserve Chair Jerome Powell kept hopes for future rate cuts alive, keeping inflation at the centre of market attention.

On the other hand, the Japanese yen continues to show clear weakness. Despite recent economic data pointing to a slight improvement in Japan’s services sector activity and wage growth, Bank of Japan (BoJ) Governor Kazuo Ueda maintained a cautious stance at his recent press conference. In my opinion, this led markets to dismiss any likelihood of a rate hike before next March. These developments have pushed the yen to lower levels, widening the yield gap between the U.S. and Japan.

In my view, the yen’s weakness is driven by several key factors. First, the BoJ’s continued ultra-loose monetary policy, compared to the relatively hawkish stance of the U.S. Federal Reserve, encourages capital flows toward the dollar, adding downward pressure on the yen. Second, markets are still waiting for more clarity on Japan’s wage growth, as the BoJ views real wage growth as the decisive factor for the timing of any rate hike. At the same time, rising inflation in Japan’s services sector could increase pressure on the BoJ to reconsider its policy stance in the future.

It seems that the divergence in policy expectations between the U.S. and Japan plays a pivotal role in supporting the dollar against the yen. Market expectations that the Federal Reserve will continue its tightening policy — even at a slower pace — point to a continued relative advantage for the dollar. Additionally, stronger U.S. economic data strengthens the dollar’s position as a safe-haven currency, especially amid global uncertainties. However, these trends could shift if U.S. inflation data comes in weaker than expected, prompting a reassessment of the Fed’s monetary policy path.

Geopolitical and trade risks also play a crucial role in influencing currency movements. Any escalation in geopolitical tensions could drive investors back to safe-haven assets like the yen, despite its current weakness. Additionally, any unexpected intervention by Japanese authorities to support the currency could reshape the outlook and add further complexity to market expectations.

Therefore, I believe the future of the USD/JPY pair will depend on several factors, including U.S. inflation and employment data, wage and inflation developments in Japan, and any surprises from central banks. Given the current conditions, the yen is likely to remain under pressure in the near term, with potential volatility if new signals emerge regarding a possible shift in Japanese monetary policy.

In conclusion, it appears that financial markets are in a state of caution and anticipation, with economic data playing a critical role in guiding currency movements. While the dollar benefits from positive momentum, the Japanese yen remains at the mercy of cautious monetary policy and external pressures, presenting investors with complex challenges when making future decisions.

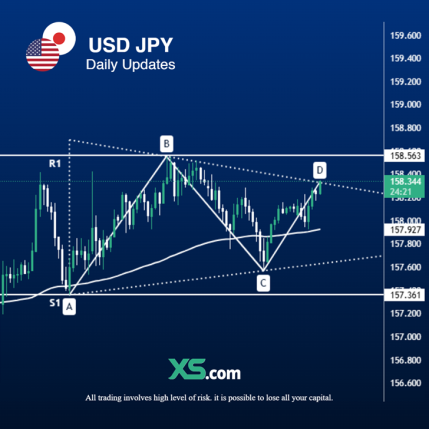

Technical Analysis of (USDJPY) Prices:

The hourly chart shows that the USD/JPY pair is moving within a potential Harmonic pattern, with the price reaching a strong resistance zone at 158.63 (Point D). Momentum indicators such as the Relative Strength Index (RSI) and Stochastic are approaching overbought levels, which suggests that the pair may experience a pullback or sideways movement in the near term. Additionally, the 100-period moving average provides strong support around the 157.30 area, reinforcing the likelihood of a short-term bearish correction.

If the price fails to break through the key resistance at 158.63, the USD/JPY pair is likely to retreat toward the support level at 157.30, which represents an important ascending trendline. A break below this level would support further declines toward the 20-day exponential moving average (EMA) at 156.33, followed by 154.70, where the 50-day moving average converges with a previously broken resistance trendline. If selling momentum accelerates, an additional drop to the key support level at 153.30 could occur, which represents a major pivot point.

On the upside, a decisive breakout above 158.63 would drive the pair higher, targeting 160.20, a peak last seen in April and July 2024. In this bullish scenario, buyers could push the pair toward higher resistance levels at 162.55, followed by the 163.85-164.00 zone, where a previous resistance trendline lies, potentially posing a challenge to further upward movement in the medium and long term.

Support Levels: 157.30, 156.33, 153.30

Resistance Levels: 158.63, 160.20, 162.55