Managing your finances and increasing your savings requires effective planning. But, unforeseen events and emergencies warrant immediate cash flow which makes selling your financial assets, like a fixed deposit, a dependable option, rather than availing a loan. However, you can tend to those emergencies without breaking your FD, by taking a time-efficient, short-term loan against fixed deposit.

What Is Loan Against Fixed Deposit?

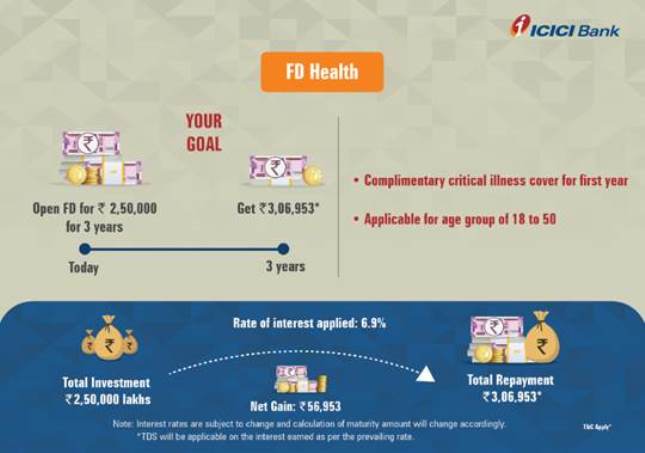

A loan against FD is a type of secured loan where you can pledge your fixed deposit as security and get a loan in return. The amount of such loans depends on the FD amount, going up to 90% – 95% of the deposit.

Advantages of Loan Against FD

- A loan against FD can be procured easily and is not dependent on your credit score. An FD makes for a common investment tool for many due to its overdraft facility. The fixed deposit can be used as collateral, thereby giving you a chance to enjoy lower FD interest rates in India.

- Usually, there is no processing fee for loans against FD. Even if there is one, it is way lesser compared to other types of loans.

- Loan against FDs is processed quickly as there are fewer documents required for existing customers. The process is much more convenient than other loan applications.

- You wouldn’t need to break any FD and incur premature withdrawal charges. These loans are granted at a maximum of 95% of your FD value, without any additional charges.

- A fixed deposit scheme offers interest on your deposit amount. Now, generally, it is believed that if you take out a loan against such assets, you might not get any interest. But that’s not true. FD deposits earn interest even during the loan tenure.

- When you avail a loan against fixed deposit, lenders keep your FD as collateral. This makes the loan thus raised secured, cutting short the interest charged on the same. In case you are not able to repay the loan amount, the lender procured it from the FD amount, settled at the time of maturity.

Eligibility Criteria for Availing Loan Against Fixed Deposit

The basic criteria to be eligible for a loan against FD is that you must hold a fixed deposit with the lender you are availing the loan from and any of the below-given individuals/entities can avail the loan:

- Resident Indian citizens

- Family trusts

- Hindu Undivided Family (HUF)

- Clubs, societies, and associations

- Sole proprietorships, group companies and partnership firms

Documentation Required For Loans Against Fixed Deposit

To avail a loan against fixed deposit, you will need to provide the following documents:

- Duly signed application form

- Duly signed agreement

- Fixed/term deposit receipts duly discharged in favour of the lender

*there are many a requirement for additional documents, varying from lenders to lenders

How To Obtain A Loan Against Fixed Deposit

Most lenders allow you to avail a loan against FD online, though there might be some cases where you might have to visit their nearest branch. You can carry out research and also apply on the lenders’ websites.

Overall, a loan against fixed deposit is a great tool to raise funds during a crisis. But you must keep in mind that it’s ideal to apply for short-term loans. If you fail to repay the loan amount, the lender forecloses your FD for loan recovery. So, make sure to borrow only that you are able to repay without creating a financial burden on yourself.