The group notes that the volume of loans has been increasing annually since its inception. There was a particularly strong growth in the last quarter of 2020 and in 2021, which confirms a rising demand for alternative lending.

Since its origination in 2013, Robocash Group has been increasing its disbursement volumes every year. Between 2014 and 2020 the yearly amount of loans issued to customers went up from 48,000 USD to 322.5 mln USD. In 2021, the total sum has reached 1 bn USD.

In Q4 2020, the group observed a particularly rapid growth rate – in this period, it granted 37.5% more loans to borrowers compared to the previous quarter. In the first months of 2021, the growth has continued. If the group maintains the pace, the amount of issued loans in Q1 this year may rise by another 20%.

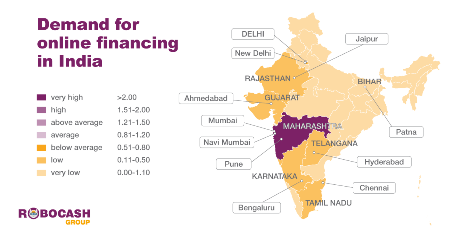

“Our statistics confirm that there is an increasing demand for alternative lending among the population. In the markets of our operation, many people still lack access to traditional financial services. For example, in Russia, Kazakhstan and Spain, the share of the underserved population varies from 44% to 53%. In Southeast Asia, around 75% of adults are either underbanked or don’t have a bank account, and in India 54% do not have full access to finance. The pandemic resulted in the underconsumption and further restrictions introduced by traditional banks, so people started using non-bank loans more frequently. We are glad to be able to partially satisfy their needs and contribute to the development of financial inclusion across our footprint,” – said Sergey Sedov, CEO of Robocash Group.

In 2021, the group plans to double the yearly disbursement volumes by expanding its product line and developing the existing services.