The coronavirus has definitely put our economy to halt, with some people losing their jobs, some surviving those jobs through pay cuts some . The current situation has led to increased adoption of Technology specially when it comes to payments. While we knew Digital is the only way forward, the country lockdown has made way for technology evolution. There are so many companies who have come up with digital solutions for consumers.

It is that time of the month where we need to pay all our basic necessity bills no matter what. Here are companies helping us pay our bills seamlessly during this cash crunch.

Simpl

Simpl is an app that provides consumers to buy now and checkout in one click with pay later functionality to build trust and provide strong buyer protection. Simpl works with merchants and financial institutions to enable a world where every monetary interaction is effortless and transparent. Through Simpl you can but things now and the accumulated bill later. As a leader in the ‘Pay later’ space, the platform is working in collaboration with some top merchants across categories – Dunzo, BigBasket, 1mg, Licious, Furlenco, etc.

Xpay

Blockchain-based platform XPay. Life offers an array of digital payment services, including touch screen ATP kiosk, web, mobile app, POS device and others. The platform caters to both B2B as well as B2C segment. The company providing the highest level of transparency during transactions. It has partnered with leading banks to further expand its reach. XPay.Life has completed 1 Lakh transactions worth INR 5 Cr, since its beta version launch in 2019. The company offers services across 18+ cities in India with 50K plus pin code locations. In the last ten months, it also claims to have achieved 100% month-on-month growth. People can pay for their Electricity, Mobile prepaid & postpaid services, DTH, Broadband, LPG, Loan EMI, etc. through the Xpay Life App and web version. The platform has 253 billers across Tier 1 & 2 towns and wide reach to 50000+ pin codes in Tier 3 and Tier 4 cities across India.

Paytm

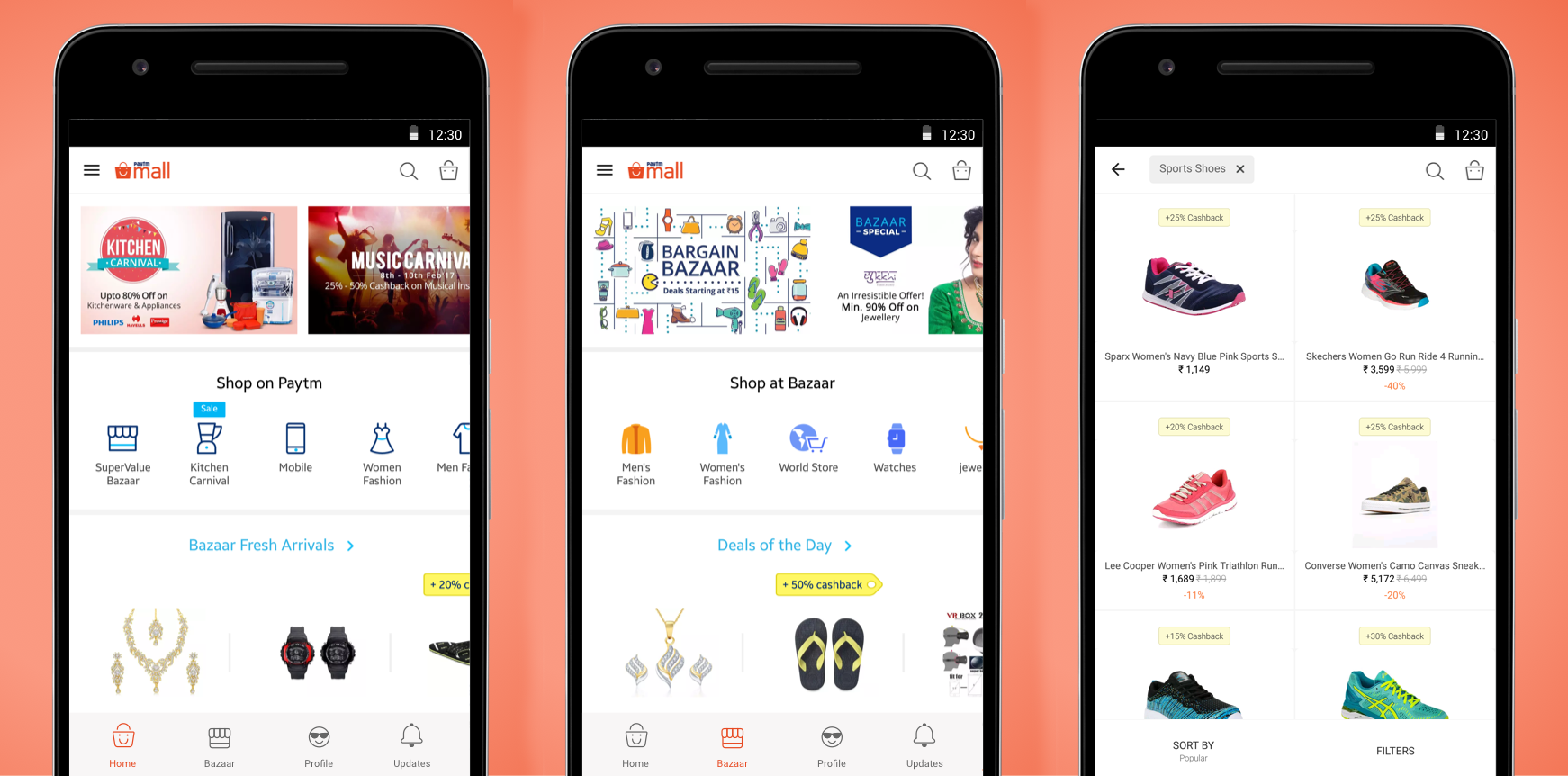

Paytm is India’s leading payment gateway that offers comprehensive payment services for customer and merchants. We offer mobile payment solutions to over 7 million merchants and allow consumers to make seamless mobile payments from Cards, Bank Accounts and Digital Credit among others. We pioneered and are the leader of QR based mobile payments in India. With the launch of Paytm Payments Bank, we aim to bring banking and financial services to half-a-billion un-served and under-served Indians. Our investors include Softbank, SAIF Partners, Alibaba Group and Ant Financial.

Freecharge

Freecharge is one of the popular mobile payment apps in India that is owned by Axis Bank. The application is used by customers to recharge their mobile phones, pay utility bills, do online shopping and also use the unique ‘Chat n Pay’ service. The Freecharge wallet service was launched in September 2015, and has ever since introduced a number of attractive features.

Mobikwik

The platform enables users to discover retailers (brick-and-mortar stores, e-com websites, m-com apps, billers, telcos) and make payment at such retailers in 1-tap. International recharges is another rare service that MobiKwik has recently enabled. It enables users to make recharges across 150+ international operators in local currency.